tax shelter real estate definition

AL Alabama Real Estate Exam Prep. The methodology can vary depending on local and international tax laws.

Using Your Real Estate Investments As A Tax Shelter

A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income.

. What is a Tax Shelter. An establishment that houses and feeds strays or unwanted animals. In the past both the staff of JCT and the Senate Finance Committee have recommended that corporate participants be required to disclose to shareholders the payment of understatement penalties exceeding 1 million and assessed in connection with a corporate tax shelterThe JCT staff further recommended that the disclosure be in the form of a separate annual statement.

A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money. Popular tax shelters include real estate projects and gas and oil drilling ventures. Someone who thinks a feature of the tax code giving taxpayers the ability to reduce taxes is.

Something that provides protection. 448a3 prohibition defines tax shelter at Sec. 461i3 provides that the term tax shelter.

See also abusive tax shelter. The most common tax shelter is through such retirement accounts. View the definition of Tax Shelter and preview the CENTURY 21 glossary of popular real estate terminology to help along your buying or selling process.

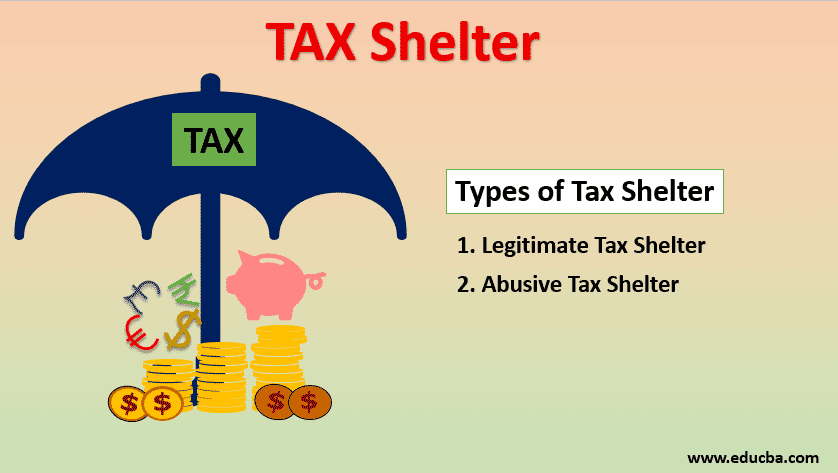

A tax shelter is a method used by businesses and individuals to reduce their tax liabilities. Types of Tax Shelters Investments. A tax shelter is an investment that generates either tax-deferred or tax-exempt income.

Abusive tax shelters are a consequence that resulted from Congress allowing losses of revenue to be used for tax benefits. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. The phrase tax shelter is often used as a pejorative term but a tax shelter can be a legal way to reduce tax liabilities.

Shelters range from employer-sponsored 401 k programs to overseas bank accounts. A tax shelter takes advantage of various aspects of the tax code. A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to limited partners or limited entrepreneurs.

A number of real estate tax shelter exist. The term tax shelter means. For example there are several retirement plans available for any individual to opt for that help reduce tax liabilities.

A tax shelter is a legal way of investing in certain plans or schemes that reduce the overall taxable income of the taxpayers and therefore save the taxes that are paid to the state or federal governments. CO Colorado Real Estate Exam Prep. DE Delaware Real Estate Exam Prep.

The IRS allows some tax shelters but will not allow a shelter which is abusive. A tax shelter is different from a tax haven which is a place outside. Tax shelters are ways individuals and corporations reduce their tax liability.

CT Connecticut Real Estate Exam Prep. Your Entity Could be Considered a Tax Shelter Under the New Tax Law. For example it may generate tax-deductible losses via the use of depreciation or interest expenses.

It is a legal way for individuals to stash their money and avoid getting it taxed. CA California Real Estate Exam Prep. Definition of Abusive tax shelter.

A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to limited partners or limited entrepreneurs. A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. Pick a state where youre taking your Real Estate Exam.

AZ Arizona Real Estate Exam Prep. Tax shelters work by reducing your taxable income thereby reducing your taxes. The new tax law has two provisions which are subject to a small business threshold.

Many people think of tax shelters negatively but they are completely legal and legitimate ways to decrease your taxable income. Definitions for selected commonly used office and industrial terms were gathered from real estate associations research organizations developers brokerage firms and technology providers. 448d3 which states that the term tax shelter has the meaning given such term by section 461i3 Sec.

A tax shelter is a place to put your money where it will be safe from the long arm of the Tax Man. AR Arkansas Real Estate Exam Prep. AK Alaska Real Estate Exam Prep.

Or a tax shelter can take advantage of incentive tax deals or of. Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any Federal or State Agency has the authority to regulate the offering of securities for sale 2. There is a penalty of 1 of the total amount invested for the failure to register a tax shelter.

Common examples of tax shelters are home equity and 401k accounts. Delving into this a little further a tax shelter isnt too far off the first definitions mark while having nothing to do with the second. Many business owners have heard that this threshold has increased substantially to an aggregated 25 million average annual gross receipts and they stop there.

An investment that produces relatively large current deductions that can be used to offset other taxable income. Murphy Real Estate Agent Keller Williams Realty Atlanta Metro East. A tax shelter is used to lower the amount owed in taxes in a legal manner as defined by the IRS and the tax code.

Constructed definitions then solicited comments and feedback from NAIOP members and industry consultants. Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs. Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities including state and federal governments.

However when the claims are exaggerated those tax. They are a side-effect of tax deductions that companies are entitled to claim. The failure to report a tax shelter identification number has a penalty of 250.

On the other hand tax evasion is used to lower the amount of taxes owned by using intentionally illegal methods that are considered a federal offense and punishable by law.

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download

How Physicians Can Shelter W 2 Income With Real Estate Professional Status Reps

What Is The Definition Of Tax Shelter Business Interest Expense

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download

The 25 Best Tax Havens Around The World

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download

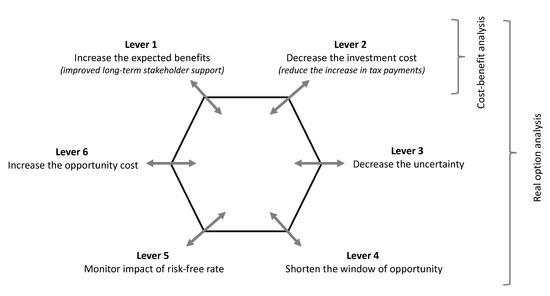

Sustainability Free Full Text A Real Option Approach To Sustainable Corporate Tax Behavior Html

/shutterstock_98009558-5bfc477846e0fb0051823da0.jpg)

Tax Havens All You Need To Know

Tax Shelter Difference Between Tax Shelter And Tax Evasion

What Is A Tax Shelter And How Does It Work

Tax Shelters For High W 2 Income Every Doctor Must Read This

Income Debt And Federal Tax Shelters

Tax Shelters Definition Types Examples Of Tax Shelter

Tax Shelter Definition Examples Using Deductions

Real Estate Development Definition Process And Management Grin

Tax Havens Current State Pros And Cons By Maria Gabriela Calderon Arnaldo Busutil And Anturuan Stallworth April 12 Ppt Download